Are you ready for Blockchain?

Emerging technologies like blockchain which manage cryptocurrency transactions have the potential to be big game changers for the investment management sector. According to the World Economic Forum, assets worth up to 10% of global GDP may be held within a blockchain system by 2027.[i] Leading the way in testing blockchain technology are organisations like the Commonwealth Bank in Australia (CBA). Sophie Gilder, Head of Blockchain at Commonwealth Bank believes “blockchain technologies will significantly alter capital markets dynamics, changing the way participants interact, with increased efficiency having positive impacts on risk, cost and transparency.”[ii]

So what are the benefits of using blockchain and how do you ensure your organisation is ready to utilise this technology?

First things first: what is blockchain?

Blockchain is an encrypted, distributed database shared across multiple computers or nodes which are part of a community or system. What makes it one of the most exciting technologies around is its ability to reduce the possibility of fraud by even its own operators. And this is particularly useful in heavily regulated industries like the investment and financial sectors.

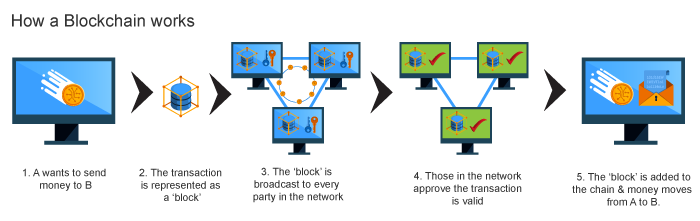

When a “block” or transaction occurs, all parties involved in the blockchain must agree the transaction is valid by collectively signing it off using cryptography. Once a transaction has been added to the blockchain, it cannot be moved or altered in any way which means there’s an accurate, traceable and irrefutable record of all historical transactions. This combined with the public nature of the blockchain provides greater transparency over the entire process and reduces the risk of data tampering.

What are the key benefits of blockchain?

In industries like financial services and investment management, blockchain can help make the compliance process simpler and easier. It may also help to maintain data quality by ensuring it’s complete, consistent, timely, accurate, and widely available. Some other key benefits include:

- Improved integrity as users can trust transactions will be executed exactly as the protocol commands. This removes the need for a trusted third party which in turn reduces/eliminates counterparty risk.

- Greater transparency as changes to public blockchains are seen by all parties.

- All transactions are immutable, meaning they cannot be altered or deleted.

- Interbank transactions can take days to clear and reach final settlement. Blockchain transactions can reduce transaction times to minutes and are processed 24/7, speeding the whole process up.

- By eliminating third party intermediaries and overhead costs for exchanging assets, blockchains have the potential to greatly reduce transaction fees and current costs.

Building blocks for banks

So how are banks like the CBA using this technology? In an effort to simplify their investment process, they’ve been trialling a system where investors and investment managers are able to enter bid tickets directly into a blockchain via a simple interface. This will remove multiple handling and ensure that ownership and payment happen at the same time.

According to CBA, the inability of the title to move without the payment will have a huge impact. “That is a huge benefit because you don’t have to worry about settlement risk any more – it is instantaneous and it is binary, it either happens or doesn’t,” says CBA Executive General Manager of Business and Corporate Finance George Confos. “Mundane, manual processes prone to error just disappear.”[i]

What challenges does blockchain present?

There are challenges in implementing any emerging technologies and blockchain is no exception. Some of the key barriers are:

Integration is one of the main barriers to implementing blockchain technology. In most cases implementation of blockchain requires organisations to make significant changes to, or completely replace their existing IT systems. In order to make the switch, companies must strategize the transition and develop a clear IT strategy and roadmap.

- Managing complex blockchain systems require substantial amounts of computer power which comes at a cost

- While blockchain offers tremendous savings in transaction costs and time, the high initial capital costs to set up and implement blockchain systems could put some organisations off.

It’s time to take action

To remain competitive, investment management organisations must invest in leading technology solutions like blockchain to differentiate themselves in a highly competitive market.[1] Innovative investment management software like AlphaCert enables organisations to bring together data from disparate sources,

Blockchain is just one of a number of technological enhancements transforming the investment sector and organisations need to be ready to embrace change. This requires having a robust IT strategy and roadmap. Organisations much also be prepared to invest in continual improvements as technology evolves.

Are you ready for change?

Here at AlphaCert, we’re consistently looking for ways to ensure that our customers are able to work with disparate data sources – and blockchain is no exception. To find out more about how AlphaCert can help you make decisions based on data of the highest calibre, please just get in touch.

[i] Financial Review, January 2017 http://www.afr.com/technology/cba-puts-government-bonds-on-a-blockchain-20170123-gtx1ff

[i] Global Agenda Council on the Future of Software & Society Deep Shift Technology Tipping Points and Societal Impact, Survey Report, September 2015, http://www3.weforum.org/docs/WEF_GAC15_Technological_Tipping_Points_report_2015.pdf

[ii] Commonwealth Bank of Australia Newsroom, January 2017 https://www.commbank.com.au/guidance/newsroom/CBA-and-QTC-create-first-government-bond-using-blockchain-201701.html